There are an estimated 500 million smallholder farmers who live and work in low- and middle-income countries and are highly underserved by critical services. For example, lending currently reaches no more than 2% of demand contributing to low farm productivity. As a result smallholders often struggle to pay basic expenses such as school fees, and get trapped in persistent cycles of indebtedness.

MEET PATRICK, 38, A SMALLHOLDER DAIRY FARMER IN KENYA.

He has a 2.5 hectare plot where he grows staple crops mainly for subsistence, although occasionally he’s able to sell surplus at a local market. Like most of his neighbors, he depends on household members for farm labor. He is part of a coop and an informal savings group which helps him save throughout the year. His main concern is to support his children’s education and household needs. Without easy access to credit and with resources always scarce, he supplements his farm income with wages earned from casual labor whenever he can.

“I want to become a professional farmaer. I want to secure my kids’ education, I want to export to other places and contribute to the future of my country.” – Patrick, Nandi County, Kenya

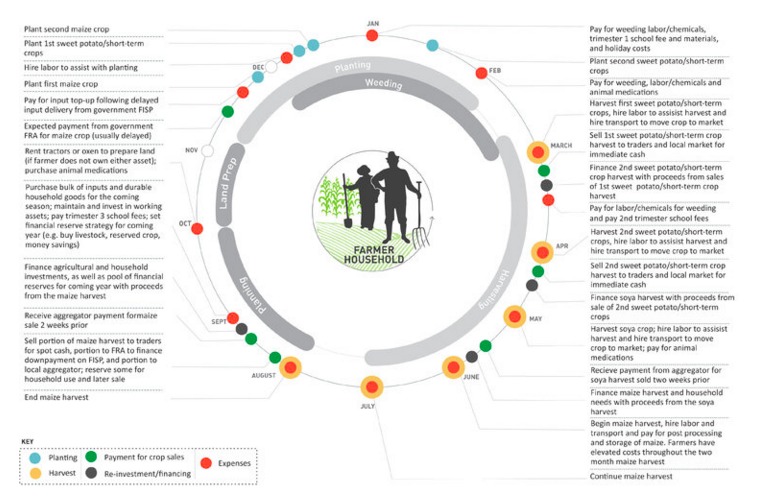

To understand the best way to help Patrick, we mapped his financial considerations throughout the year. His expenses – such as purchasing inputs, paying for day labor, etc. come regularly throughout the year. His income, however, is limited to the few time during the year when he harvests his crops. This disconnect between expenses and income can put stress on smallholder farmers like Patrick, and drives him to sell to middlemen at poor prices, or take high-interest emergency loans when his cash flow is poor.

CHALLENGE #1

SMALLHOLDER FARMERS NEED BETTER ACCESS TO QUALITY INPUTS AND AGRONOMIC INFORMATION TO IMPROVE FARM PRODUCTIVITY.

I have to wait until the harvest before I get any income, and by then, I have other loans to clear. Chances are what remains is not enough to buy the inputs I want for planting the next season. – Farmer Peter, Ol’Kalou, Kenya

PROPOSED APPROACH

Bundled Digital Financial Services Tailored to Farmer Needs: A digital platform to enable access to discounted inputs and agricultural credit, as well as educational services and customized farm reports for dairy farmers in Kenya. Designed and tested with a telco in Kenya.

KEY FEATURES

Detailed design, prototypes and product strategy for a USSD-based application:Enabling farmers to buy inputs, access financial services and share best-in-class agricultural advice.

Partnership strategy: Bringing together and incentivizing multiple players to deliver the service.

Pilot support: Bringing the solution to life through a product feature roadmapping strategy, and support in post-launch monitoring & evaluating, and iteration on product UX design.

CHALLENGE #2

SMALLHOLDER FARMERS NEED BETTER ACCESS TO MARKETS, WITH THE SUPPORT OF REGULAR BUYERS AND CONSISTENT PRICING.

So what happens if I am able to afford better feeds for my cows, and they start producing more milk, but there is nobody to buy it? Will prices be even lower? – Wilson, Dairy farmer in Bomet, Kenya

PROPOSED APPROACH

Bundled Digital Services & Buyer Forward Contracting: A suite of digital information and financial service products for smallholder farmers in the maize ecosystem in Tanzania. This platform can improve access to information and financial services and leverage multiple private sector partnerships to guarantee purchasing. Designed and tested with an intergovernmental organization in Tanzania.

KEY FEATURES

Design recommendations for a suite of digital products: Providing access to finance and information services for farmers, including facilitation of digital forward contracting with buyers to ensure reliable market access.

Enabling environment recommendations for implementing partners: Including process improvements, training programs and incentive models to ensure platform adoption and engagement.

CHALLENGE #3

SMALLHOLDER FARMERS NEED BETTER WAYS TO SUPPORT THEIR DIVERSE APPROACHES TO INCOME GENERATION, BOTH ON AND OFF THE FARM.

Whatever maize I don’t sell right after harvest to pay my to pay my loans, I keep stored in my store room, and if it’s a lot; like last year I bought a cow. So then when I need cash I will sell produce, but the market might be very bad at that time.” – Oliver, maize farmer, Tanzania

PROPOSED APPROACH

Layaway Solutions Portfolio: A portfolio of concepts including a technology-enabled vendor toolkit and loyalty program to promote layaway behavior for a variety of agricultural and non-agricultural purposes. Designed and testing with an NGO in Senegal.

KEY FEATURES

Mobile vendor tools: Empowering vendors to take on greater responsibilities and engage and support farmers more frequently and consistently.

Farmer loyalty program: Helping farmers develop sound financial habits through a gamified reward and recognition system, while promoting regular and continuous engagement with the layaway platform.

Package portfolio: Supporting diverse approaches to income generation for individuals and savings through a suite of offerings including single-products and bundled packages.

CHALLENGE #4

SMALLHOLDER FARMERS NEED RAPID ACCESS TO CREDIT FOR EMERGENCIES AND OPPORTUNISTIC NEEDS.

Before the harvest I have nothing. I’ve had all expenses all throughout the year but no income and by that time my produce stores are empty. If there were any emergency I would have to lean on my neighbors. – Helen, maize farmer, Kenya

PROPOSED APPROACH

Customized Digital Credit Solutions: A range of improvements and customizations to existing digital credit solutions in Tanzania spanning the full customer lifecycle. Designed and tested with a telco in Tanzania.

KEY FEATURES

Flexible credit: Providing farmers with access to the funds they need, when and how they need it.

Integrated savings: Encouraging farmers to save for their future and improve their creditworthiness.

Expert agent network: Connecting farmers to a more supportive network.

End-to-end marketing: Communicating value from start to end.

Responsive USSD application: Providing a self-supporting digital experience for all users