Development Impact Bonds (DIBs) are a relatively new results-based financing instrument being piloted as a new way of financing innovative activities. Dalberg designs, manages and evaluates DIBs, such as the Educate Girls DIB, and many others across the globe. Yet, while we see the DIB model playing a powerful role in catalyzing private capital to complement traditional development efforts and funding sources, we know it is not the best fit for every context.

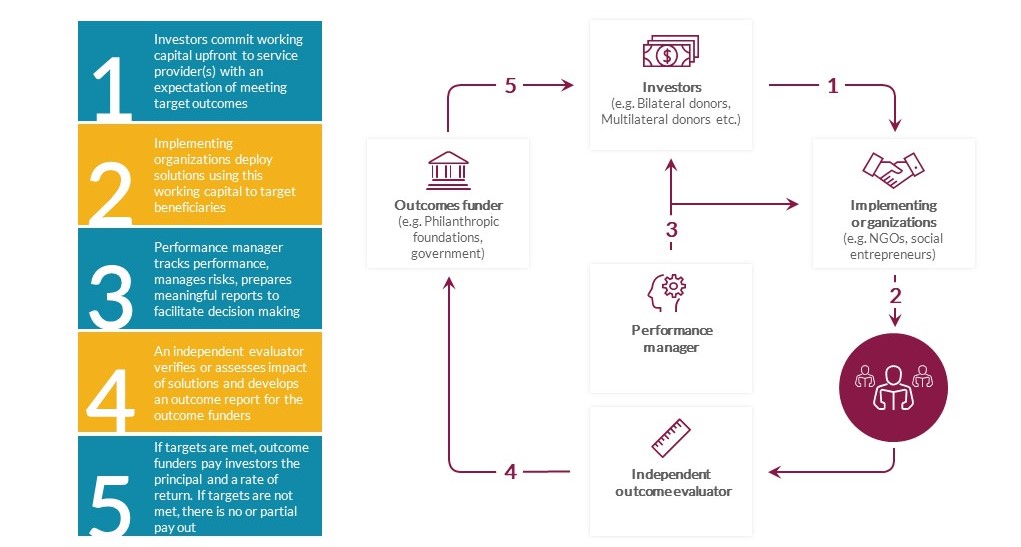

But how do they work? DIBs are results-based contracts in which one or more private investors provide working capital for social programs, implemented by service providers (e.g., NGOs), and one or more outcome funders (e.g., public sector agencies, donors, etc.) pays back the investors their principal plus a return if, and only if, these programmes succeed in delivering results. They are the same as Social Impact Bonds (SIBs), with one key difference. In a SIB the outcome payer is typically the government in high-income countries, while in a DIB the outcome payer is typically a private donor or aid agency.

How do Development Impact Bonds work?

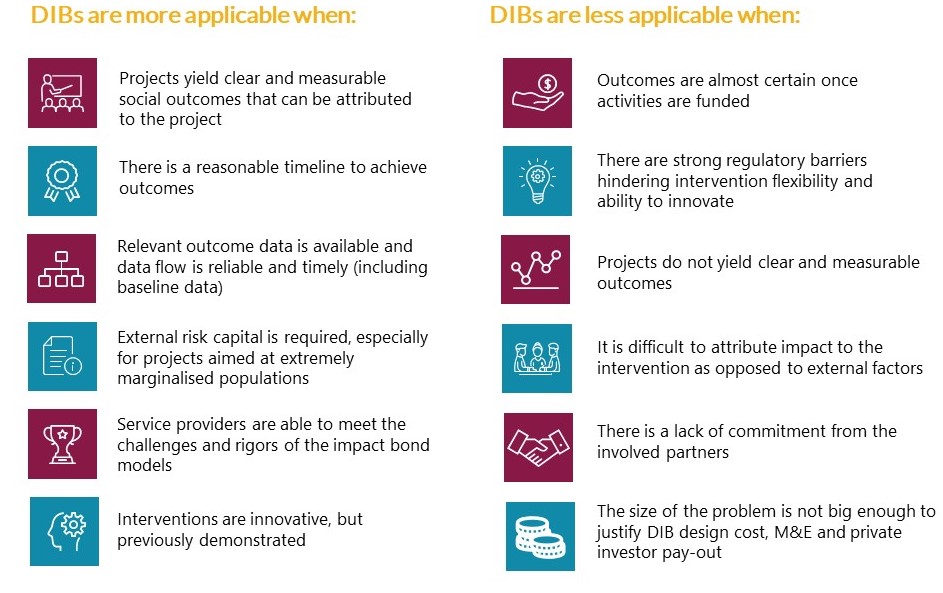

When to use a DIB? DIBs are most appropriate in scenarios when there is an actor that is willing to pay for the results, but not willing to bear the risk that the activities won’t yield the desired results. As such, DIBs present an alternate pathway to funding by involving investors that have more flexibility in where and how they choose to invest their money, after accounting for the risk adjusted return.

But DIBs are not always the best fit for every context. If you’re considering DIBs, we have developed a checklist that uses twelve screening criteria to help you refine your program design—or else determine that another results-based financing mechanism may be more appropriate.

When is a Development Impact Bonds most applicable?

DIBs are not suitable for every problem in development, but in many cases it will be worth considering whether the approach can lead to better results, produced more efficiently than with alternative approaches. When used in the right context, this approach can create space for more innovation, local problem-solving and increased transparency to target beneficiaries and taxpayers in donor countries.

Working on Development Impact Bonds or want to know more? Get in touch with gaurav.gupta@dalberg.com (Asia), carlijn.nouwen@dalberg.com (Africa), or kusi.hornberger@dalberg.com (Americas)