Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

The dramatic reduction in United States Overseas Development Assistance (ODA) in recent months has created a significant funding gap for impact areas globally, and particularly in Asia. The United States Agency for International Development (USAID) had deployed $5 billion to Asia-based programs in 2023, of which a significant amount was channeled through multilateral institutions such as the World Bank and the Global Fund[1]. While USAID represents a major share of U.S. development spending in the region, the U.S. has additional funding commitments in the region, including from federal agencies. Moreover, the U.S. is not alone in reassessing its aid commitments in the region, as other donor countries grapple with domestic challenges and fiscal constraints.

Philanthropy, particularly overseas philanthropy, while valuable, constitutes a much smaller pool of capital. Its role is best suited to targeting high-impact gaps and acting as a catalytic force rather than serving as a replacement for ODA. To put this into perspective, the top ten philanthropic funders in Asia—including institutions such as The Hong Kong Jockey Club Charities Trust, the Nippon Foundation, and Singapore’s Tote Board—collectively contribute an average of $2.1 billion annually, equivalent to only 42% of USAID funding in the region.

Meanwhile, Asia continues to face major challenges requiring substantial capital investment. Whether addressing poverty, navigating climate adaptation and mitigation, managing the needs of a rapidly aging population, or responding to disruptions in the labor market from the rise of artificial intelligence, the region’s funding requirements far outpace current investment levels. Failure to mobilize adequate resources toward these challenges could result in a future marked by scarcity, disruption, and conflict.

Asia’s Untapped Potential in Impact Investing

One promising solution lies in redirecting more capital toward impact investing—a tool with the potential to mobilize resources at a scale that matches Asia’s development needs.

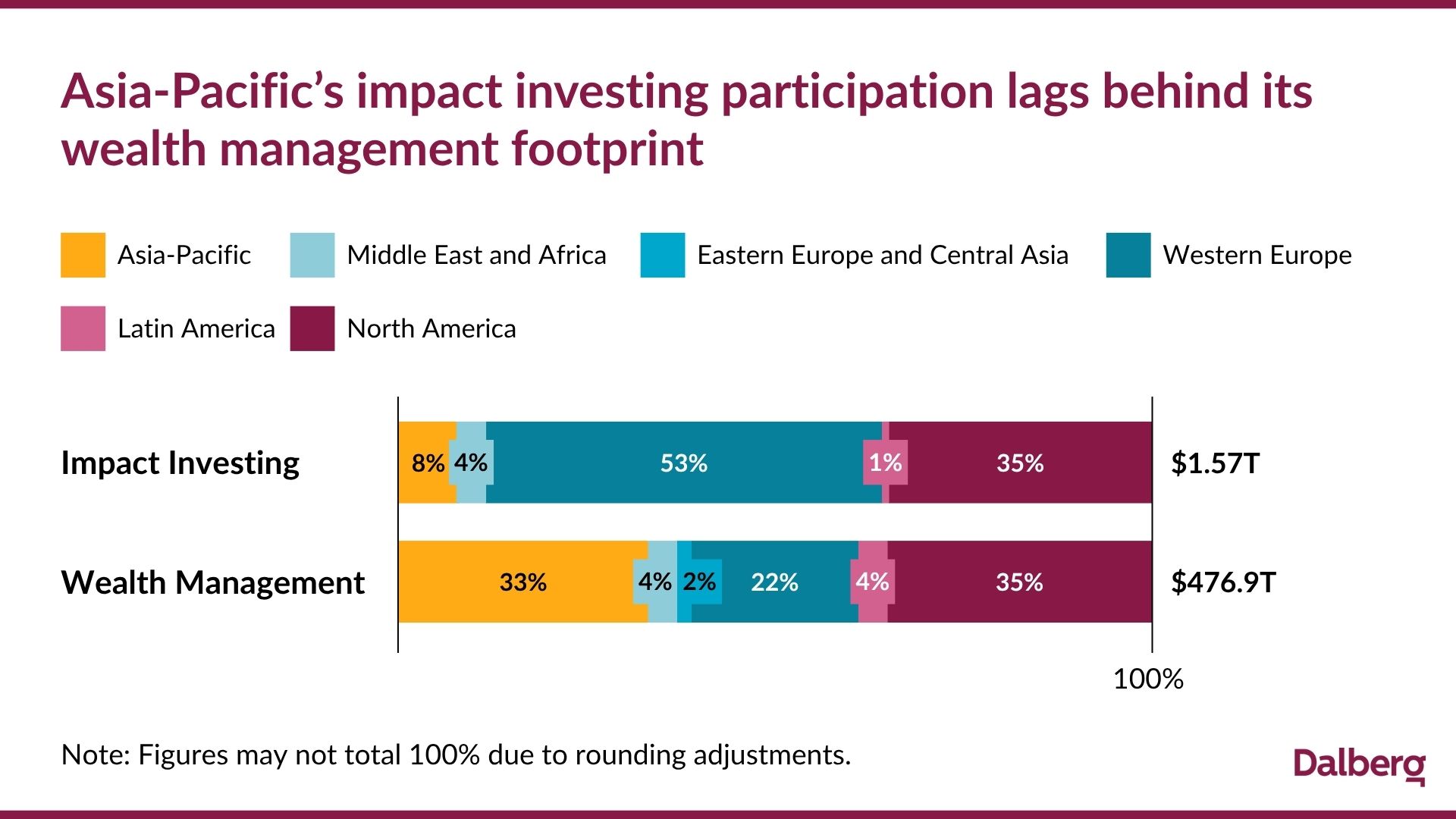

Private impact investing represents a much larger capital pool than either ODA or philanthropy, with approximately $80 billion in assets under management (AUM) in Asia. However, there is still considerable room for growth. Despite Asia accounting for roughly one-third of global wealth management assets, it only represents 5% of the $1.57 trillion global impact investing market—a significant underrepresentation.

This gap is not set in stone. If Asia were to achieve proportional participation in the global impact investing market, the region’s sector could grow from its current size to $520 billion—more than quadrupling existing levels. Such an expansion would more than offset the decline in development aid and enable a wide array of commercially viable solutions to pressing societal challenges.

Promising Trends and Developments

While impact investing has been on the agenda for years, its traction in Asia has been limited. Interviews with regional investors reveal that many remain unconvinced that impact investing—particularly with the expectation of achieving both market-rate, risk-adjusted returns and social impact—is viable. Nevertheless, several encouraging developments suggest that this perception is beginning to shift.

First, a massive generational wealth transfer is on the horizon. Over the next decade, a significant portion of Asia’s private wealth will pass to younger heirs, many of whom are more motivated to deploy their capital for impact. An estimated $5.8 trillion of wealth will be transferred by 2030, and within the next 10 years, $2.8 trillion will be transferred in China alone. Research shows that millennials are nearly twice as likely as previous generations to engage in impact investing. They also demonstrate a higher tolerance for illiquid, long-term investments—a crucial trait given the extended time horizons often associated with impact ventures. This trend could help create a critical mass of success stories, gradually warming Asia-based investors to the potential of impact investing.

Second, Asia’s philanthropic organizations are increasingly exploring blended finance as a strategy to attract private capital into impact sectors. Mirroring efforts by the development finance community to extend the reach of their funds and enhance sustainability, philanthropies in Asia are beginning to adopt blended finance approaches to crowd in private investment and expertise. These efforts are motivated by the desire to unlock larger volumes of capital and integrate commercial acumen into social and environmental problem-solving—following the example of global initiatives like the SDG Loan Fund and the MacArthur Foundation.

Third, global progress in impact measurement is helping reduce transaction costs and improve performance, making impact investing more accessible and attractive. Initiatives such as Impact Frontiers have developed robust measurement standards now widely adopted by impact funds. Meanwhile, companies like 60 Decibels are offering innovative, cost-effective tools such as standardized phone surveys and benchmark databases to support consistent and comparable impact assessments. Likewise, our inaugural collaboration with ABC Impact on the Voices from the Portfolio report drew on feedback from more than 1,800 end-users across five investees to reveal both intended and unintended outcomes and spotlight opportunities for continual improvement.

The Path Ahead

To truly harness the potential of impact investing, Asia must develop the broader ecosystem required to support it. Experiences from other markets, like the U.K. and the U.S., show that a thriving impact investment sector needs more than just funders and investees. It also demands a cadre of experienced fund managers skilled in both commercial investing and impact management, as well as intermediary organizations offering services such as advisory and structuring.

One illustrative example is the U.K.’s use of £600 million in dormant account funds to establish Big Society Capital (now Better Society Capital). This organization seeded the first generation of impact fund managers and funded intermediaries, playing a pivotal role in developing sectors such as social lending, impact bonds, and social housing in the U.K.

Asia is well-positioned to pursue similar models. With strong financial hubs like Hong Kong, Singapore, and Tokyo, the region already has many of the building blocks required, including a sound regulatory environment and a deep talent pool.

If Asia can build on the promising trends outlined above, create a pipeline of local success stories, and cultivate a supportive ecosystem for impact investing, it can dramatically expand its share in the global impact economy. Doing so will not only help fill the growing gap left by declining aid but also steer capital toward building a more inclusive, resilient, and sustainable future.

[1] Unrestricted/core funding that the U.S. had deployed to multilaterals, which were eventually deployed in Asia, is not included as part of this $5B.

To know more, contact: