Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

A community of individuals and organizations that are actively investing in private healthcare services in emerging markets is coming together to expand knowledge and develop best practices.

At least half of the world’s population lack access to essential healthcare services, and low-and middle-income countries bear the brunt of inadequate healthcare systems, accounting for 75% of globally preventable deaths. Each year 5.7 million people die in developing countries because of poor quality healthcare, surpassing the 3.6 million lives that are lost due to a lack of access to healthcare. Nearly 100 million people are pushed into poverty each year by out-of-pocket expenses.

In these low-and middle-income countries, the private sector already plays an important role in both healthcare delivery and financing, providing access to quality, essential healthcare services and safe, effective, and affordable medicines. In Africa, private providers currently administer half of all healthcare, and in South Asia, this number is close to 80%. In these regions, people’s healthcare needs far outweigh what the public sector is able to provide, and if existing private sector capacity, investment, and innovation are leveraged, more could be done to address the issues of access, quality, and cost.

Until now, private capital investment in the sector has been informal, unorganized, and unregulated, which can present a potential risk to the very people, systems, and providers it sets out to serve.

For instance, thin investment pipelines that lack financing capacity can threaten reliable access to care, while the creation of new private healthcare institutions can generate a market imbalance that diverts resources such as doctors and nurses from public health systems. Moreover, private sector investments can expand access to care for underserved populations, but they rarely target the most vulnerable customers whose access to health services is key to reaching universal health coverage.

One of the approaches that set investment in inclusive healthcare apart is the substantial investor and public-private sector collaboration that takes place to provide care structures with the greatest positive impact.

Creating Cohesion in a Nascent Investment Sector

Carving out new territory, Investors for Health (I4H) was founded in 2019, with a mandate to promote inclusive healthcare provision through investment in healthcare providers. It does this by bringing together investors, DFIs, impact investors, private equity (PE) funds, VC funds, and others who, in addition to generating commercial returns, work together to ensure that capital is deployed to achieve impact and build out integrated healthcare systems in emerging markets.

A few months later Covid emerged to turn the world of healthcare provision upside down in both developed and emerging markets, setting the stage for change.

Dalberg serves on the Investors for Health Executive Committee, alongside Alta Semper, British Investment International, the International Finance Corporation (IFC), and Quadria Capital. Dalberg Advisors serves as the community manager for the platform, helping to foster connections between members and bring them together in ways that create knowledge, provide education, and help investors be more impactful in their investments. To date, Dalberg’s activities have included organizing a series of events that help match investors and share information, as well as co-producing the flagship report.

I4H members must be actively placing capital in investments in the health space in emerging markets, with the expectation of return. This requirement ensures that members have topic expertise and sector intelligence to share with the other companies on the platform. The companies represented are all in some way showing what it means to chart new territory in filling the gaps in public healthcare systems and uncover new opportunities for better and more sustainable healthcare processes and practices.

Through the efforts of Dalberg and others, countless new links have been made between organizations that are making investments in healthcare in emerging markets, and inclusive investment needs relating to access, affordability, and quality have been identified. In addition, a new relationship with another community of practice that is focused on Ministries of Health has been established.

The Case for Private Investment in Emerging Markets

Supporting healthcare providers directly is a path where private capital is well equipped to help fill gaps and expand access to quality care for the underserved, as well as play its part in the goal to achieve Universal Healthcare Coverage (UHC) by 2030, as set out in the United Nations Sustainable Development Goals (SGDs). One of several barriers in the way of achieving UHC is an annual funding shortfall of $134 billion identified by the WHO – which is expected to grow to over $370 billion a year by 2030.

Prior to Covid, the narrative around private investing in healthcare in emerging markets was nascent and gaps between what the public sector was able to provide and what populations needed were undefined. Private sector players were hesitant to be the first movers in a relatively uncharted space with uncertain returns – and opportunities were unrealized.

To enable private investment to be put to work for the countries and areas of inclusive healthcare that need it most, it will need more blended finance, impact bonds, and other financing vehicles for scaling and de-risking in order to attract investment to the sector as it emerges. Catalytic financing from the development sector could also launch funds that can fully develop a broader investment ecosystem in the emerging markets healthcare space. But although investment in emerging market healthcare is on the rise, and it is attracting academic attention, the territory remains mostly uncharted for investors.

Across the pandemic, the I4H focus on investment in inclusive healthcare became increasingly urgent. I4H platform participants gathered on calls to share insights and data that gave shape to the understanding of the private investments that were already underway, and the opportunities for both returns and social impact in the near- and long-term future.

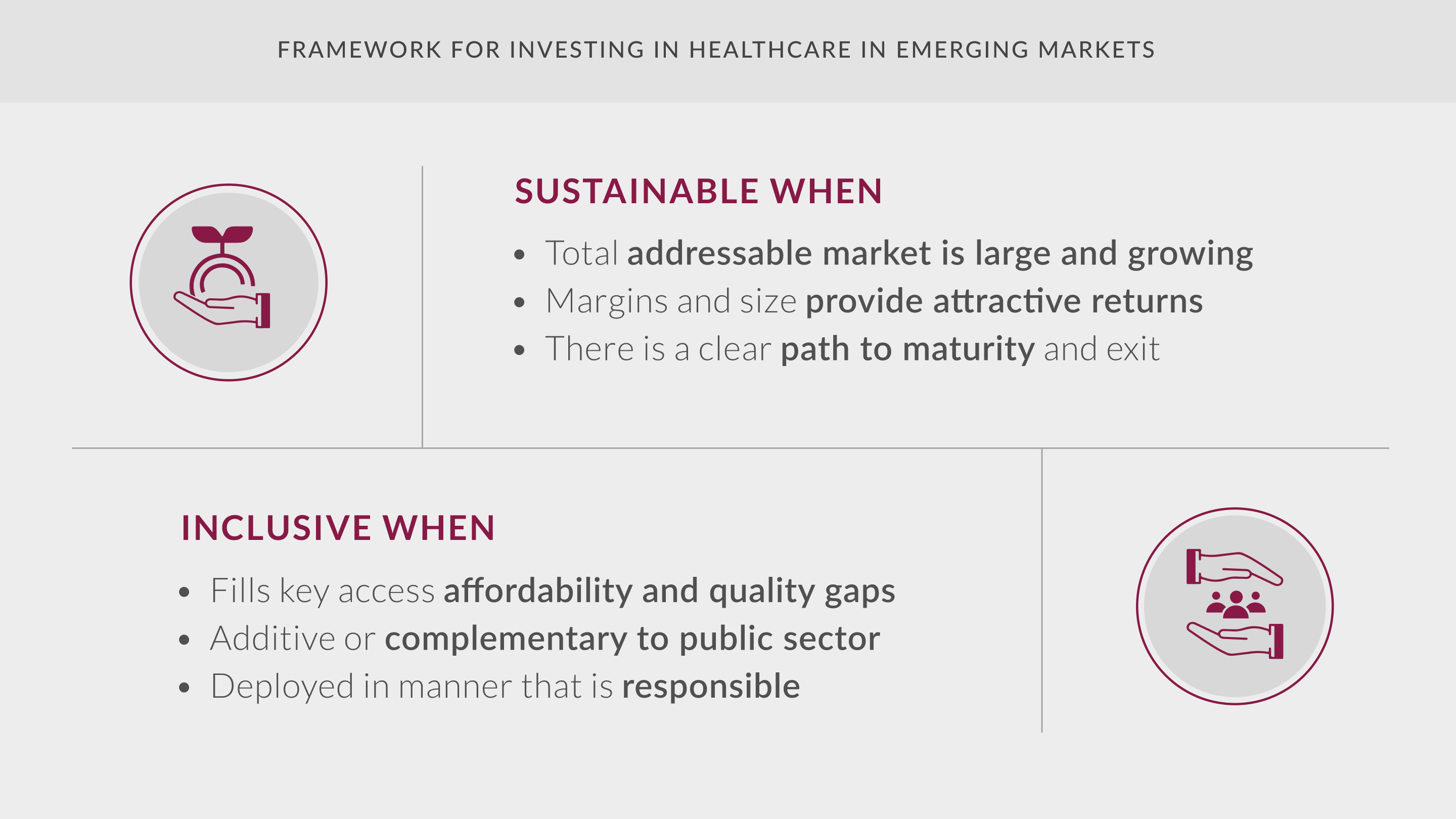

Together, the information they shared coalesced into a framework for investing in healthcare in emerging markets that serves as a grounding point for high-impact, sustainable, inclusive investments. And the topics of access, affordability, and quality in emerging markets became more mainstream. I4H companies were not only gaining vital information for their own businesses – they were forging an exciting and impact-filled path ahead for even greater inclusive investment in the future.

Inclusive Investment in Action

I4H members generate impact across the spectrum of healthcare interventions in emerging markets, helping to close the gaps in primary care, specialty care, diagnostics, and addressing weaknesses in supply chain and HR management. The focuses of their investments range from digital/telehealth services, pathology labs, hospitals, imaging, medical distribution, distributions of consumables and supplies, distribution of equipment, specialty clinics, to primary care, and others.

One I4H member is backing a provider that tackles the problem of limited ICU infrastructure and the shortage of skilled critical care physicians in remote locations. Technology-driven tele-ICUs from the provider Cloudphysician have filled a gap, offering healthcare services and a med-tech platform to address the lack of access to quality critical care in ICUs across the globe. Telehealth and digital health services represent a breakthrough in addressing issues of scarcity and remoteness and are of great interest to the I4H community.

In Kenya, another member-backed provider, Ilara Health, provides laboratory and imaging diagnostic services and is increasing access to affordable diagnostics by equipping healthcare facilities with devices on a pay-as-you-go model. In this way, they have improved diagnostic services in over 400 clinics in Kenya at a cost of $200 per month.

Investments are only considered inclusive if they fill key gaps in access, affordability, and quality of health services; add to existing public sector services without extracting its resources, and responsibly deploy capital in accordance with international standards and good governance practices. For these inclusive investments to also be sustainable, investors must also consider the size of the market, the expected return per deal, maturity, and average ticket size. Inclusive investments allow private sector investors to contribute toward Universal Health Coverage by extending healthcare coverage to underserved populations.

Opportunities in Healthcare Delivery Beyond Covid-19

The I4H report “Private Capital’s Role in Healthcare Delivery in Emerging Markets beyond Covid-19” builds on insights from the I4H community as well as on the supply-demand gaps analysis currently being led by the IFC health economics team. IFC is the top provider of commercial financing to health transactions and is a pioneer in the blended finance for health space. In making the case for private investment, the report points out where the largest gaps exist in healthcare service delivery. In showing how investments can be addictive, it draws on the setup of I4H members’ investments in emerging markets’ healthcare delivery and services.

According to the report, the use of digital and telehealth services has been greatly accelerated by the COVID-19 pandemic, and I4H investors believe that telehealth is here to stay. India, for example, has more than 5,000 health-tech start-ups, and the industry is currently pegged at $1.9 billion. These start-ups have secured funding of around $2.5 billion, further confirming that technology is poised to strengthen India’s healthcare ecosystem for years to come. Recent analysis also suggests that, after Covid, private equity (PE) firms that formerly favored investing only in traditional healthcare companies are warming to the idea of investing in health tech firms.

The greatest barriers to investment cited by respondents in a members survey include business model risk, complex political, legal, and regulatory structures, weak infrastructure, difficulty in sourcing talent, the availability of professional management, and the capacity of the population to seek, obtain and pay for care.

Other barriers include the need for risk-pooling or insurance mechanisms, and “unreliable payments by public institutions/insurance,” the absence of which is a critical constraint to health service investing. Infrequently reported issues include corruption, leakage, fragile IP protection, and limited public information.

They also cited finding suitable companies to support ‘deal flow’ as a major barrier to investing, with 60% of respondents reporting difficulties with the capital pipeline at the origination stage. Others found challenges in deploying and managing their investments in emerging markets.

Catalyzing Private Funding

As it looks to the future, I4H will continue to serve as an emerging-market-specific sector voice and catalyst, helping to encourage the kind of investments needed to cover the spectrum of need in countries where public systems are stretched to their maximum, or require new kinds of care to increase access, better patient safety, or support caregivers.

It will remain a place for exploration, open discussion, and the kind of dynamic interaction needed to capture the opportunities – for both investors and communities – in the provision of healthcare in emerging markets today.

If you would like to learn more or become a member of our community please email us at: contact@investorsforhealth.com