Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

As the global ESG (Environmental, Social, Governance) movement gains momentum, the “S” in ESG often receives less attention than its environmental and governance counterparts. However, the social dimension is critical for building resilient, inclusive, and sustainable businesses. Measuring “S” is essential for companies to align with stakeholder expectations, drive long-term growth, and make informed business decisions. Despite its importance, businesses face several challenges in measuring the “S” effectively. Here, we delve into why measuring “S” matters, the tools and frameworks available, and examples of companies that have successfully incorporated social metrics into their strategies.

Key Challenges in Measuring “S”

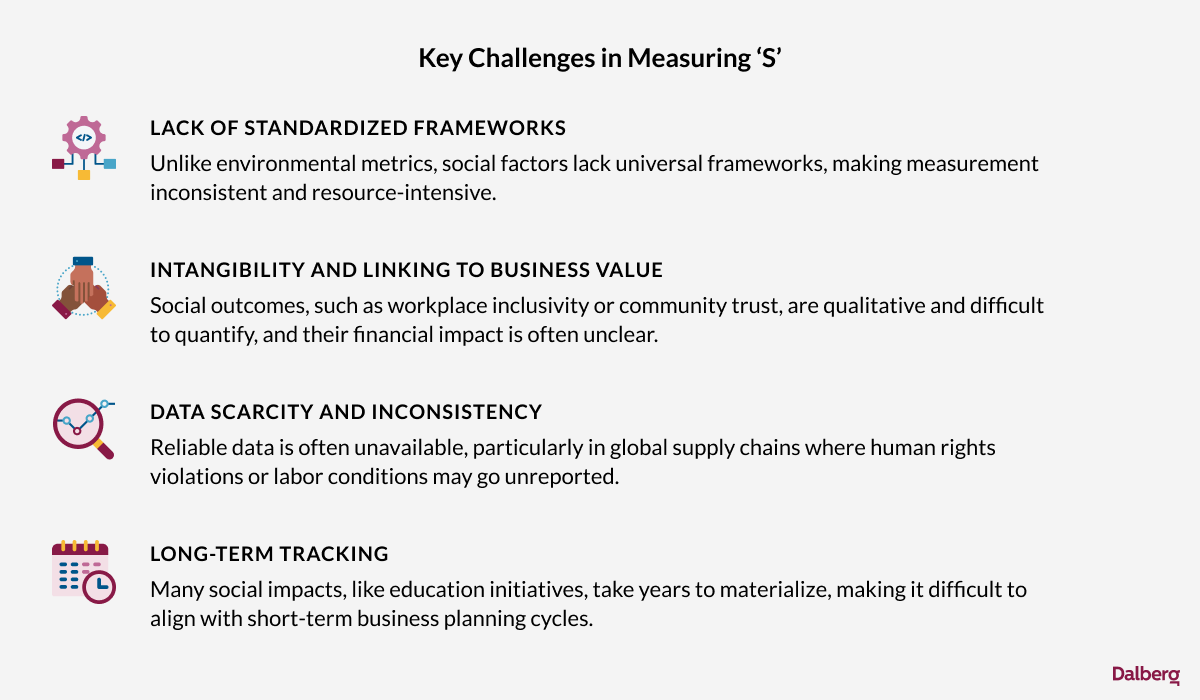

Measuring the social component of ESG is complex, spanning factors like diversity, labor conditions, and human rights. Its unique challenges are highlighted in the visual below:

These challenges underscore the need for innovative tools and structured approaches to measuring social impact effectively.

The Importance of Measuring “S” and Designing a Framework to Measure It

Measuring “S” in ESG goes beyond compliance with regulations like the EU’s Corporate Sustainability Due Diligence Directive (CSDDD). It enables businesses to identify impactful interventions and align social initiatives with business objectives. By tracking metrics, companies can tailor their efforts to improve operational efficiency. Strong measurement also helps secure leadership buy-in by linking investments to outcomes that can reduce risk or improve innovations.

Additionally, it builds competitive advantage by fostering stakeholder trust and ensuring operational resilience. For example, companies like H&M have implemented supply chain transparency programs to monitor and report on factory working conditions, addressing compliance gaps faster, reducing reputational risks, and strengthening their appeal to socially conscious consumers.

Building a robust framework to measure the “S” in ESG begins with clarifying objectives. Whether measuring to track progress, report outcomes, influence decision-makers, or improve decision-making, businesses must create tools that align with these goals. Regardless of the objectives, one should keep in mind the principles of materiality, measurability, actionability, and alignment with standards.

1. Prioritize Materiality and Relevance

Focus on social issues that are significant to both the business and stakeholders. Conduct materiality assessments to ensure resources address high-impact areas.

2. Define Measurable and Actionable KPIs

Establish clear, SMART (Specific, Measurable, Achievable, Relevant, Time-bound) metrics to track progress and drive improvements. Embed logic about the drivers of key outcomes to credibly inform decision-making.

3. Align with Global Standards and Regulations

Align metrics with globally recognized frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) standards and ensure compliance with emerging regulations such as the EU’s CSDDD. This approach sets up companies to benchmark against peers, comply with regulations, and attract stakeholders who prioritize ESG.

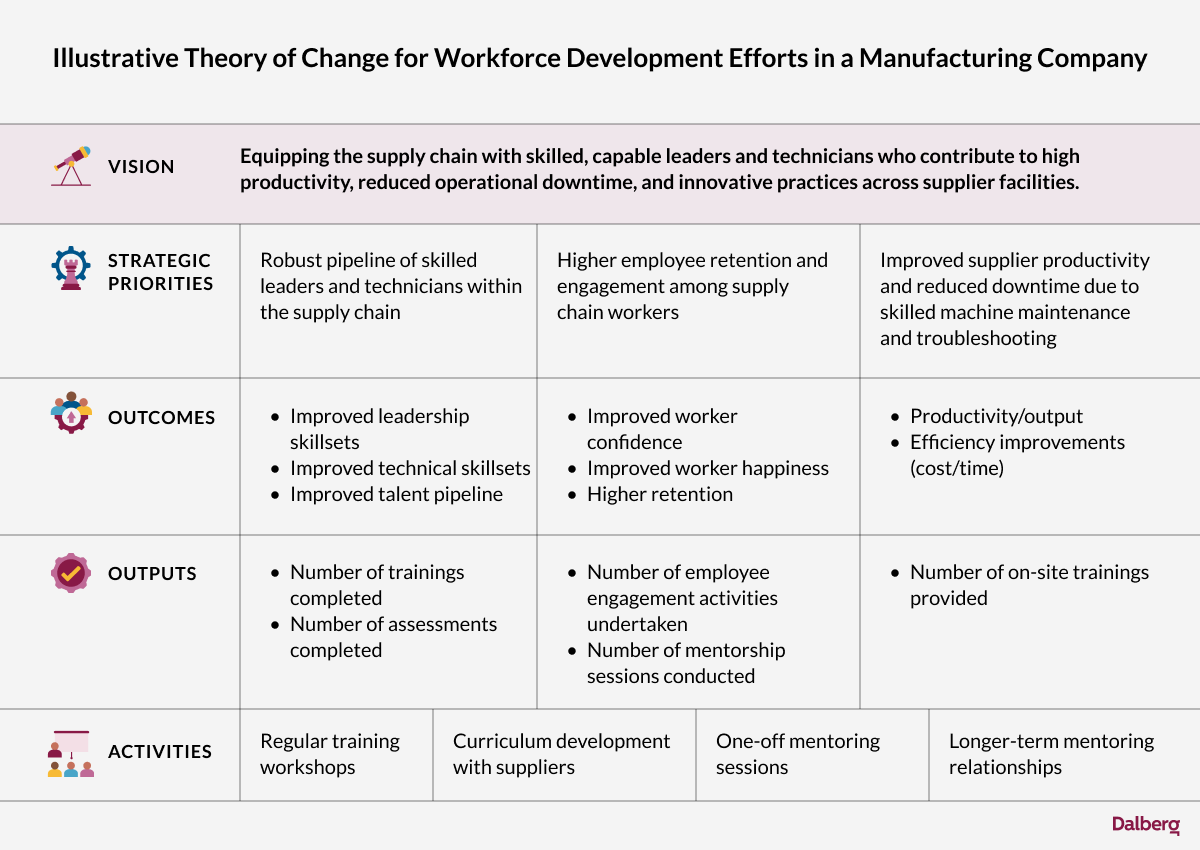

4. Use a Theory of Change (TOC) to Drive Strategy

Develop a Theory of Change to map activities to measurable outcomes and connect social impact to business performance. TOCs are most often associated with the social impact sector; however, the concept is a neutral one and especially effective for tying social and or environmental impacts to business metrics and is increasingly used by industry leaders in corporate sustainability. Below is an illustrative TOC for a manufacturing company with sustainability efforts focused primarily on supply chain workforce development.

5. Simplify and Implement for Real-World Impact

The most effective measurement frameworks are actionable and adaptable to existing systems. Avoid over-complication and focus on building systems that enable data collection, tracking, and course correction.

For instance, most corporates do not publish their approach to implementing measurement frameworks because it is often still a work in progress and betrays the limitations of their current systems. When recently working with a leading mining company, Dalberg engaged team members across business units upfront both to define and test potential tools for collecting key data within their current business processes. The result was a pared down, but practical, framework that they have been able to report against from Day 1 and are now able to build from in line with their capabilities.

A measurement framework should thus balance ambition with practicality. By aligning social impact metrics with business goals and integrating them into operational systems, businesses can drive both social and financial outcomes while building sustainable, impactful strategies.

The Business Case for Measuring and Integrating “S” in ESG

A holistic approach to measuring the E, S, and G enables companies to navigate trade-offs, make informed decisions, and achieve balanced outcomes. For instance, transitioning to energy-efficient manufacturing (E) must also account for social implications like potential job losses (S), with solutions such as workforce development programs ensuring environmental progress aligns with social goals.

Measuring and integrating “S” with broader ESG metrics also strengthens a company’s ability to communicate its impact to stakeholders. A cohesive strategy that links environmental, social, and governance initiatives demonstrates how these pillars work together to drive long-term value. Through its Livelihoods Funds for Family Farming (L3F), Danone tracks key metrics such as smallholder farmer incomes, crop yields, and soil health to assess the impact of its sustainable agriculture initiatives. By using these metrics, Danone identified gaps in training for women farmers and tailored programs to improve their financial literacy and farming techniques. This data-driven approach has not only helped farmers adopt climate-resilient practices (E) but also improved the average income of farmers by 15% (S).

Ultimately, aligning “S” metrics to business KPIs—such as employee retention, operational efficiency, or customer loyalty—ensures that these initiatives deliver both social impact and financial returns. Companies like Unilever, Patagonia, Transurban, and Danone, show how integrating social metrics into core operations not only enhances resilience but also creates competitive advantages. By prioritizing “S” today, businesses can drive sustainable growth and secure a more inclusive tomorrow.

Connect with Layusa to know more about Dalberg’s work in ESG strategies: