Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

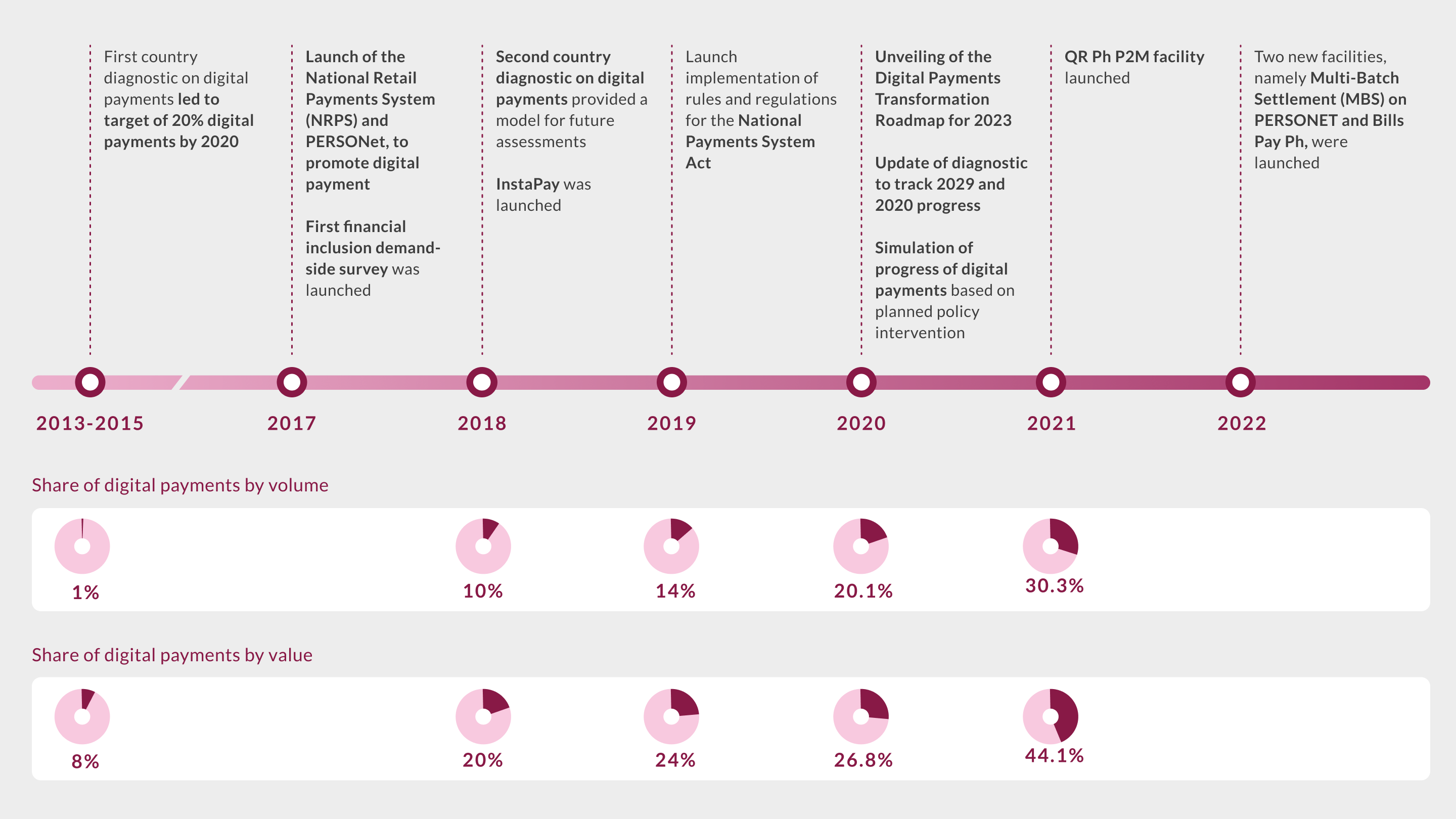

Constant evaluation, proactive policies, and institutionalized data systems have propelled the country’s volume of digital payments from 1 percent to a staggering 30 percent in 8 years — and the growth has been inclusive. In 2013, digital payments formed just 1 percent of transactions in the Philippines, according to a diagnostic by the country’s central bank, Bangko Sentral ng Pilipinas (BSP). The bank cited three roadblocks to digitalization at the time: an unbanked population, the informal nature of Filipino businesses, and low mobile penetration rates. However, by June 2020, the Philippines had rallied to increase total digital payments to 20.1 percent, above its 20 percent target. That volume surged to 30.3 percent in 2021. Notably, the rise has been bolstered by women users, who appear to be embracing digital payments more than men. But what factors are fueling this digital transformation? Better than Cash Alliance partnered with Dalberg to analyze the Philippines example for insights. Our case study report showed that success was derived from a series of practical steps by the government alongside the private sector. Three in particular stood out.

1. Constant evaluation of progress against transparent targets

Prior to BSP’s 2013 diagnostic, there was sparse data on digital payments adoption and usage in the Philippines. The realization that digital payments were a vital step towards the country’s digital economy sparked investments in the payments infrastructure over the ensuing years. On its part, BSP committed to monitoring the growth of digital payments.  Figure 1. BSP has progressively set up critical infrastructure and tracked the rise of digital payments. A second BSP diagnostic in 2018 showed clear improvements. Digital payments had soared to 10 percent by volume and 20 percent by value of the total. Crucially, the diagnostic created a model that still serves as a baseline for future monitoring.

Figure 1. BSP has progressively set up critical infrastructure and tracked the rise of digital payments. A second BSP diagnostic in 2018 showed clear improvements. Digital payments had soared to 10 percent by volume and 20 percent by value of the total. Crucially, the diagnostic created a model that still serves as a baseline for future monitoring.

Buoyed by the 2018 results, the Philippines committed to bold targets: achieving 50 percent of digital payments by volume as well as 70 percent financial inclusion by 2023.

To advance action towards these goals, BSP regularly showcases current data on digital payments, alerting public and private stakeholders where concerted action is needed. The apex bank also forged strategic partnerships and coordinated with other agencies to underscore the government’s support for digitalization.

2. Proactive policymaking

The 2013 diagnostic led BSP to introduce legislative and regulatory frameworks to help digital payments flourish. To that end, they launched the National Retail Payments System in 2015 to address the lack of digital payment channels. Then, the National Payments System Act of 2018 gave the BSP the power to manage all payment systems, bringing them under one set of rules for supervision. As the payments industry in the Philippines matured after the second diagnostic, BSP switched to a use-case method to encourage the uptake of digital payments. InstaPay was established to allow for person-to-person instant payments of small amounts. For person-to-merchant use, BSP brought stakeholders together to create QR Ph, the national standard QR code in the Philippines.

BSP made it a priority to understand how policies affect digital payments. For example, what would drive the use of standardized codes on merchant payments?

As officials formulate policies to spur digital payments, they could find it hard to measure their effectiveness. That’s why Better than Cash Alliance and Dalberg developed a policy simulator with BSP in 2019 to determine which policies should be prioritized, which variables they can control, which parties they should involve, and what conditions will spark growth. With the help of this simulation, two new facilities — Multi-Batch Settlement (MBS) on PESONet and Bills Pay PH were launched in 2022.

3. Institutionalizing data systems and investing in capacity

For a full picture of the state of payments in the country, it is important to have access to data from companies that are not regulated by the BSP. However, collating the information takes up more bandwidth, and often makes tracking take longer. So, in 2020, BSP started the Electronic Payments and Financial Services Monthly Report, a framework for collecting data that gives a more frequent and focused look at the state of payments. This means that financial institutions controlled by the BSP have to provide complete data on digital payments made by retail customers in the Philippines, including all priority cases and indicators. At the same time, BSP will be pioneering a lighter reporting requirement that reduces the monthly costs of compliance for financial institutions and urges them to update their datasets more often. Lastly, BSP has built up its own ability to gather and examine payment data to help make policy. They have also invested in a data team charged with keeping track of digital payments and communicating with public and private parties to monitor the effects of certain policies and make predictions about them.

Adapting lessons

Although the Philippines’ journey is distinctive in some respects, learnings from their digitalization can be applied by other countries seeking to achieve responsible digital payments. The case study report addresses these takeaways: consensus-building across the public and private sectors, investing in data-driven policymaking, and being deliberate about tracking. Get the report here.