Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

A new market incentive facility that will mobilize $700M in lending to agri-SMEs in East African economies through aligning capital supply and demand, is piloting a new data-driven approach to encouraging investment in underserved sectors.

A joint report from Aceli Africa and Dalberg framed around pivotal research and analysis of the agricultural small-and-medium enterprise (SME) sector has helped shape the offering of a new market incentive facility – Aceli Africa – and provided solutions that will make lending to agri-SMEs more available and financially sustainable.

The report is the culmination of a two and a half year journey to address the barriers to growing the finance market for agricultural SMEs, namely, the mismatch between the risk-return hurdle of capital providers, and the ability of small businesses and co-operatives to afford credit.

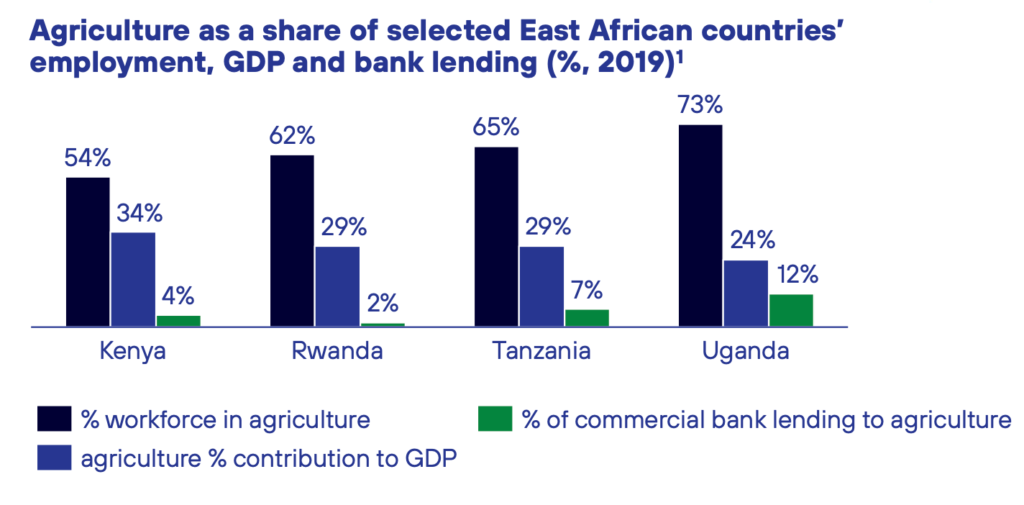

Despite 60-70% of the East African population being employed in agriculture, the sector remains chronically under-financed, receiving less than 10% of commercial bank lending in most countries – with as little as 2% in Rwanda. And, with investment in African agriculture critical to achieving the Sustainable Development Goals, solutions are becoming more urgent. In 2003 under the CAADP framework, most African countries committed to spending 10% of their budgets on agriculture, but actual spending remains about half that.

The report has the dual purpose of sharing Dalberg’s conclusions that the returns in agri-SME lending in East Africa are well below market rate and that solutions going beyond the current offer are needed, and presenting Aceli Africa’s data-driven marketplace approach to align capital supply and demand. Dalberg and Aceli also put forward a set of specific solutions informed by the new data and stakeholder insights.

As a first step, the economics of agri-SME lending across a diverse set of lenders had to be distilled and then solutions that would bridge the financing gap had to be designed. In the past, data on the economics of financing agri-SMEs has been limited, making it difficult to identify where donor or government interventions are required and how they should be designed. The gap between capital needed by agri-SMEs and that provided by the market is estimated at $65 billion a year across Sub-Saharan Africa.

Balancing value against risk

Financing is especially hard to come by for SMEs that have the potential to facilitate pathways out of poverty for smallholder farmers and rural workers. An estimated three out of four agricultural SMEs lack sufficient access to finance and the capacity to manage it.

A big portion of agri-SME lending is in the $25K-$1.5M segment, known as the “missing middle” because it falls between two lending business models and consequently is under-financed. For this segment, loan sizes and borrower profiles are too large and too risky for microfinance or retail banking, but too small and inefficient for corporate banking to serve.

Other challenges faced by lenders include the risks associated with informal value chains (i.e. most food crops) and the high operating costs and low returns associated with serving agri-SMEs. These issues continue to drive sub-par lending economics and have prevented the emergence of successful models for scaling up access to capital. Risk is at least twice as high as risk in other sectors served by the same lenders in Africa, and also twice as high for lending to agri-SMEs in Africa as in Latin America. At the commercial banks examined in this research, returns in agri-SME lending are 4-5% lower than returns in other sectors.

The report determined that many agri-SMEs are at the center of complex webs of interaction, and increasing their ability to grow will have positive spillover effects on livelihoods and food security, among others. Lenders, however, cannot capture this value today so are not taking these benefits into account in their strategies.

As the report explains, the challenges in the agri-SME lending landscape require well-designed market-level interventions, and limited financing is constraining the ability of early stage agri-SMEs to realize their growth and impact potential. Solutions would need to dig deeper.

Data that uncovers a true picture and enables a foundation for change

To overcome the lack of data, and with funding from 12 donors in partnership with Aceli Africa, Dalberg assembled and analysed a first-of-its-kind database of over 9,000 agri-SME loans (totalling $3.7Bn in size) from 31 commercial and impact lenders. The process also included extensive consultation with lenders, technical assistance providers and many other ecosystem actors. The findings explain the persistent financing gap for agri-SMEs in Africa and offer a comprehensive picture of the market and the challenges faced by different types of lenders.

Informed by the new data and stakeholder insights, the Aceli Africa team was able to design a set of specific solutions that consider the impact value of agri-SMEs, respond to the needs of lenders, and complement the range of support programs already active. The facility’s goal is to mobilize capital flows at scale and unlock the substantial impact potential of agricultural SMEs for economic growth, farmer and worker livelihoods, regional food security, opportunities for women and youth, and climate resilience across the continent.

Solutions have been designed around the report’s main conclusions, including the finding that a market-based approach is necessary to support the full range of lenders that currently serve different parts of the agri-SME economy. Providing risk mitigation, helping lenders improve underwriting, and building borrower capacity can reduce the actual and perceived risk of lending and increase addressable demand. Defraying lenders’ operating costs in the short- term will enable them to expand lending to new borrowers in less formal segments and spread fixed costs over a larger portfolio to increase operating efficiency. And finally, providing capital for innovative business models that leverage technology will help drive down operating costs in the long run.

Success in East Africa may help livelihoods elsewhere

Aceli Africa has launched with initial funding from various donors and will begin supporting lenders active in East Africa this quarter. During the implementation period, Dalberg will continue to support Aceli by conducting periodic benchmarking exercises, examining the performance and profitability of loans supported by Aceli. This is critical to ensuring Aceli’s “smart subsidy” philosophy of only providing the type and level of support that the market needs to encourage greater lending, without distorting incentives.

Success in East Africa may provide the opportunity to replicate the model in other parts of Africa, Asia, and Latin America, where agri-SMEs find credit hard to come by but essential for supporting their suppliers and employees. And in time, the same data-driven design approach may also be used to build facilities to support other types of high-impact financial and non-financial services, such as expanding access to microinsurance or finance for social infrastructure.

Read the full report here.