Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

Consumer Behaviors and Attitudes Toward Digital Financial Services in India

The emerging field of digital financial services is experiencing tremendous momentum in India. Efforts are being made across the board to pave the way for new technologies to fulfill their promise to empower consumers and change lives. Both private and public sectors are investing in building the infrastructure, products, and support frameworks needed to drive digital financial services penetration across the country’s complex marketplace. The entire ecosystem—including mobile network operators (MNOs), financial service providers, banks, regulators, and the government—is focused on a wide range of initiatives that will enable them to collectively bring mobile-powered financial services to the broadest spectrum of consumers.

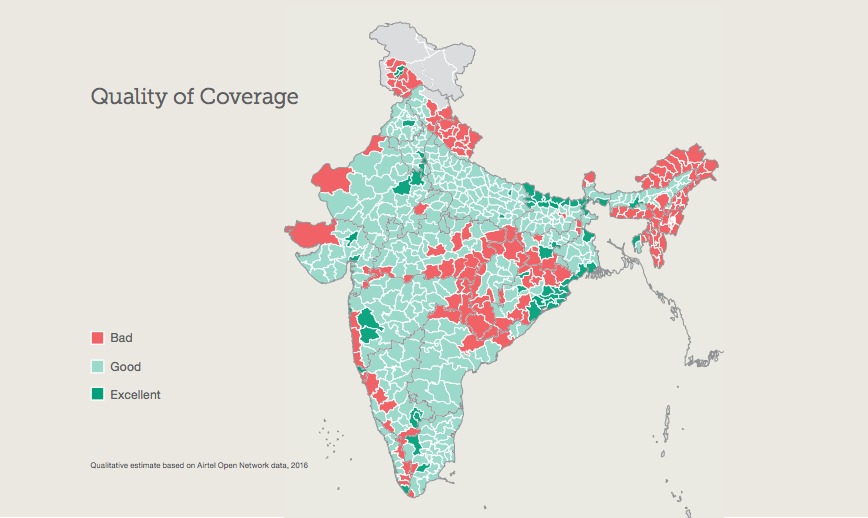

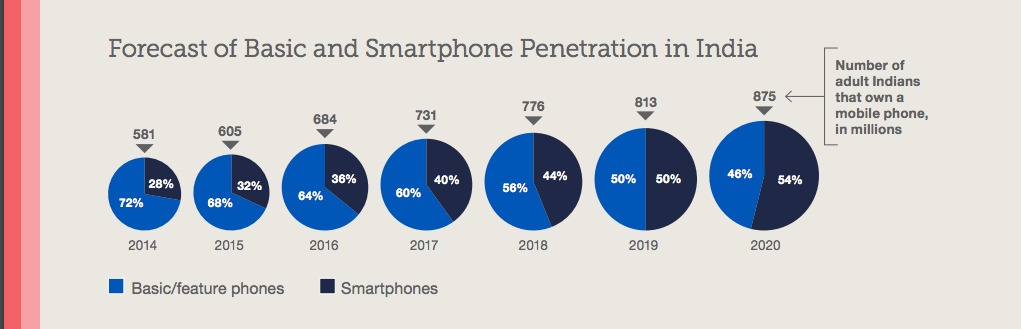

India gives every indication of being “digitally ready,” with over a billion mobile subscribers, 72 percent mobile phone penetration, including over 250 million smartphones, and an increase in monthly data usage from 89 megabytes per subscriber in 2014 to 240 megabytes in 2016. However, at the same time, large segments of the population remain in digital darkness. Fewer than five out of 10 women own a mobile phone. In rural areas, less than five percent of adults own a smartphone. Furthermore, 50 percent of smartphone owners across the country do not subscribe to data.

Despite the digital diversity in India, there is great opportunity for digital financial service providers to reach consumers with numerous form factors and data access scenarios. However, adoption of this technology across consumer segments has been slow. It is clear that delivering new product offerings to the Indian market via the mobile phone won’t be successful without a deep understanding of the complexity of consumers’ needs, desires, and behaviors across such a varied segment base.

Indian consumer segments differ greatly in their aspirations and attitudes toward technology, as well as their access levels and usage patterns. People exhibit significant differences in their appetites for change and risk, underlying values and socio-cultural norms, and levels of education and financial literacy, along with an array of multi-dimensional needs. Digital financial services providers must also understand how to leverage existing frameworks, such as door-to-door agents and community savings groups, in order to drive sustained behavior change and foster trust.

For this reason, we commissioned a comprehensive research project in 2016 that focused on surfacing the voice of the Indian consumer regarding adoption and usage of digital financial services. In partnership with Dalberg Global Development Advisors, we conducted in-depth interviews with 384 people in 30 communities across the country, analyzed macro-level data sets and trends, and spoke with over 20 industry experts to develop a detailed understanding of the drivers for the adoption of digital financial services through a behavioral lens.

This report provides a synthesis of the “Currency of Trust” study findings. Ten key insights were gleaned from the many factors that shape the consumer context. Five personas helped to distill the most influential consumer desires and challenges around technology, essentially forming a segmentation model for digital financial services.

It is critical that every stakeholder listens to, and understands, the voice of the consumer when undertaking initiatives aimed at driving adoption of digital financial services. Consumers will guide how this platform unfolds across India, and the mobile ecosystem must respond accordingly in order to unlock its potential for consumers, commerce, and the economy at large.