Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

This article is part of the Africa Food Systems Forum 2024 coverage.

With over 50% of the population in Sub-Saharan Africa facing food insecurity, Sustain Africa is stepping in to address one of the continent’s most significant challenges—limited access to affordable fertilizer for smallholder farmers. Collaborating with public and private sector partners, Sustain Africa seeks to bridge the gap between fertilizer demand and supply—a critical step in enhancing agricultural productivity on the continent. Dalberg partnered with Sustain Africa to sustainably improve fertilizer financing in Africa.

The Challenge: Overcoming the Fertilizer Financing Gap

A significant factor contributing to food insecurity in Africa is the mismatch between attainable and actual yields of staple crops, which is two to three times higher compared to leading agricultural regions in Europe and the Americas. The wide yield gap directly contributes to lower agricultural productivity.

The average fertilizer usage in Africa (22.6 kilograms per hectare) falls drastically short of the Abuja Declaration target of 50 kilograms per hectare. It is significantly lower than the global average of 139.8 kilograms per hectare. This discrepancy underscores the continent’s lag in leveraging its arable land to achieve higher yields.

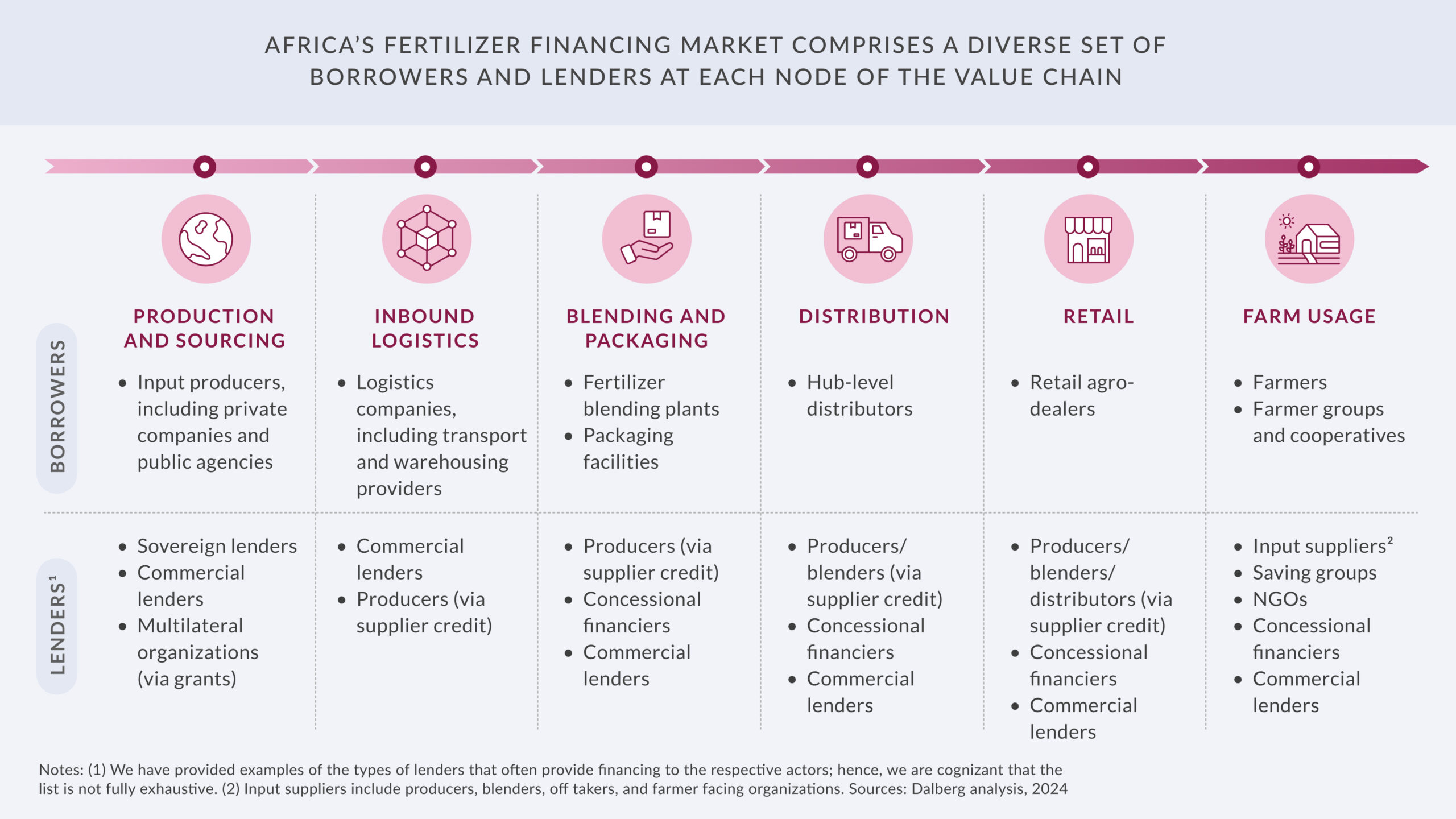

Overall, Africa has a $3 billion financing shortfall in fertilizers, hampering the availability and affordability of this important tool, especially among smallholder farmers, leading to notable low usage. Addressing this gap and enhancing the sustainable use of fertilizers in line with good agricultural practices (GAP) can narrow the yield gap by increasing crop production in Africa (see figure below to understand Africa’s fertilizer value chain).

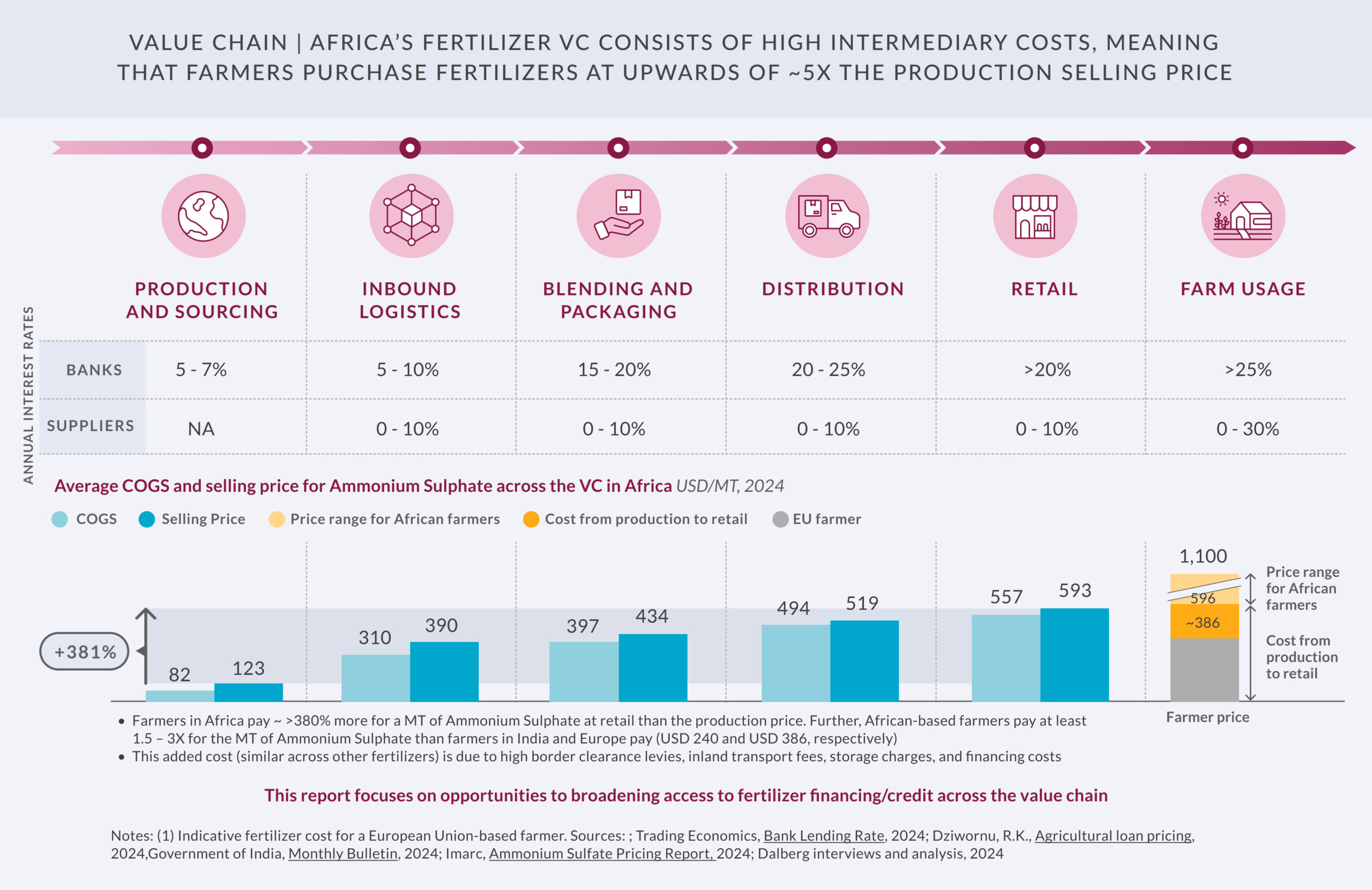

Fertilizer financing challenges primarily affect local blenders, distributors, and smallholder farmers—the key players in the fertilizer value chain, which includes production, inbound logistics,[1] blending and packing, distribution, retail, and farm usage. While producers and inbound logistics typically receive competitive financing from banks, local blenders and distributors face expensive debt and cumbersome processes to access financing. At the end of the value chain, retailers and smallholder farmers often have the least access to financing, relying on savings and informal channels.

Several critical risks exacerbate these challenges, limiting lending and widening the financing gap. These risks include:

- Business Model Risk: High costs for connecting with prospective borrowers and managing loans in underserved segments limit lending opportunities.

- Credit Risk: Delayed or denied payments by borrowers discourage lenders from engaging with this market.

- Sovereign Risk: Government interventions can distort markets and reduce lender confidence.

- Currency Risk: Unstable local currencies affect suppliers’ cash flows and deter financing.

- Commodity Risk: Fluctuations in input and output prices create cash flow concerns, further limiting financing opportunities.

Given these complexities, the question remains: How can we mitigate these risks to enhance the availability, affordability, and accessibility of fertilizers in Africa? The figure below shows the evolution of financing costs and selling prices across Africa’s fertilizer value chain.

Unlocking Financing and Boosting Local Production

Of the interventions identified in the study, one directly addresses key risks while unlocking new financing opportunities across the fertilizer value chain: incentivizing supplier credit and financing.

This intervention proposes enhancing existing initiatives like the African Fertilizer Financing Mechanism (AFFM) and the African Fertilizer and Agribusiness Partnership (AFAP) Trade Credit Guarantee (TCG) by embedding first-loss coverage, origination incentives, and impact bonuses.[2] Proposed modifications aim to transform these mechanisms from their current perception as insurance instruments into proactive tools that actively incentivize supplier credit, particularly for underserved, high-impact segments such as women-owned businesses. Further, by incorporating currency compensations to cover suppliers experiencing losses from depreciation and conditional agreements to implore governments to transition from input subsidy programs (ISPs) to this scheme, the intervention could also address currency and sovereign risks effectively.

A $300 million investment, with a target leverage of 5X annually,[3] could generate $1.5 billion in supplier credit, covering half of the $3 billion financing gap.

Key Considerations

Dalberg’s recommendations are grounded in extensive research—including interviews with approximately 40 stakeholders across the fertilizer value chain, from producers to farmers, as well as banks—and existing mechanisms like AFFM and AFAP. A key takeaway from our work with Sustain Africa is that addressing fertilizer financing challenges requires tackling risks at every stage of the value chain. Solutions focusing on just one part, such as production, will not work unless we create financing opportunities for local blenders, distributors, and retailers. Second, while blended finance can be a powerful catalyst for unlocking capital, to be effective, it must be designed to incentivize participation actively. We can encourage financial institutions to lend to previously underserved market segments by offering return enhancements and guarantees.

This approach ensures that the proposed interventions are robust and tailored to the specific challenges facing Africa’s fertilizer industry. Enhancing local production and reducing reliance on imports, which is another intervention identified in the study, strengthens Africa’s internal trade capacity, a crucial goal under the AfCFTA. By strategically addressing financing and production inefficiencies, Dalberg and Sustain Africa aim to close the fertilizer financing gap that has long constrained Africa’s agricultural productivity.

View the full report here.

———

[1] Inbound logistics is the process of importing fertilizers on a large scale before selling to blenders and distributors.

[2] First loss coverage is a policy that offers the initial partial insurance cover up to pre-agreed value or limit in the event of a claim. Origination incentives are payments to suppliers/lenders that compensate them for the lower revenues and higher operating costs of extending credit to smaller and newer borrowers. Impact bonuses are additional sums offered to lenders for extending credit to high impact segments such as women-owned and youth-owned businesses.

[3] Leverage refers to the amount of times you can extend credit from the initial loan amount.

To know more Dalberg’s work toward transforming Africa’s food systems, contact: