Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

Small and Growing Businesses (SGBs) serve as the lifeblood of inclusive growth in emerging markets. Found in all sectors of the economy, they employ and target many markets that larger businesses either cannot serve or overlook. But when SGBs set out to grow, their potential can go unrealized if appropriate financial products and services are not available.

The need for increased financial offerings for SGBs is clear: The International Finance Corporation (IFC) estimates that the micro-, small-, and medium-sized enterprise (MSME) finance gap in emerging markets is approximately US$5 trillion, and that 41% of formal MSMEs have unmet financing needs.

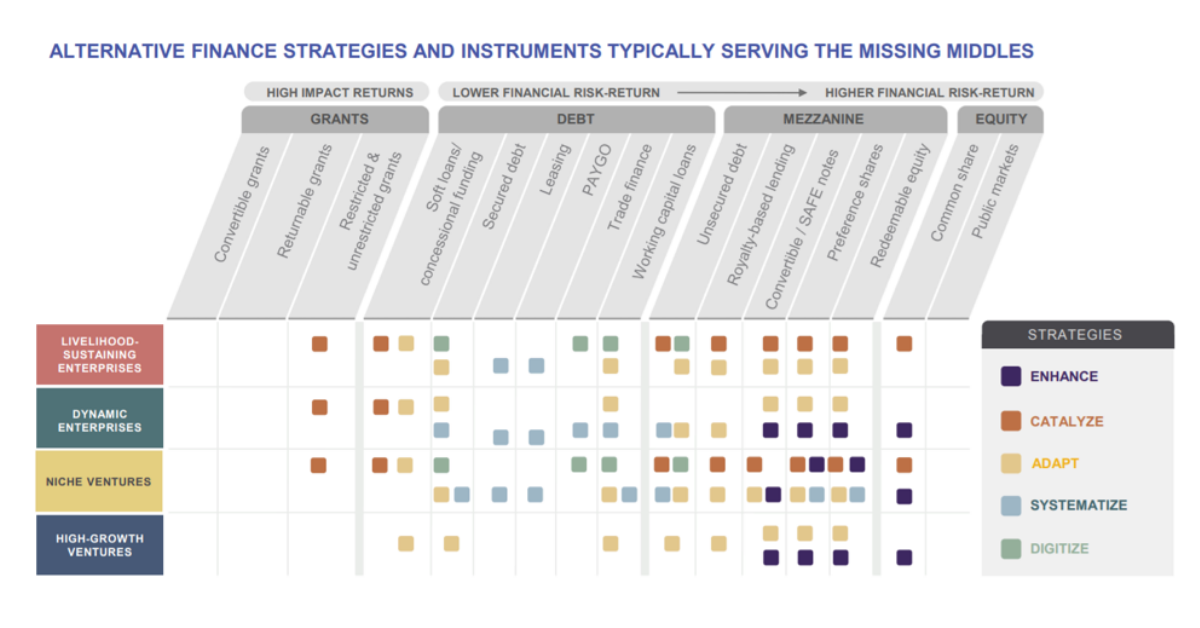

In “Closing the Gaps: Finance Pathways for Serving the Missing Middles,” a new Dalberg-authored report for The Collaborative for Frontier Finance and its founding members, five alternative approaches or “pathways” are identified that innovate on traditional finance models to meet the needs of both SGBs and the limited partners buying into these approaches.

The models include:

- Enhance the value of equity investment through sector expertise and non-financial support

- Catalyze impact and follow-on investment by blending finance to support harder-to-serve businesses or markets

- Adapt products, partners, and approaches based on specific SGB needs and local market context

- Systematize internal knowledge and processes to keep due diligence and investment costs low

- Digitize the investment process to automate decision-making and achieve a radically lower cost to serve

Learn more in the report, available for download here.