Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

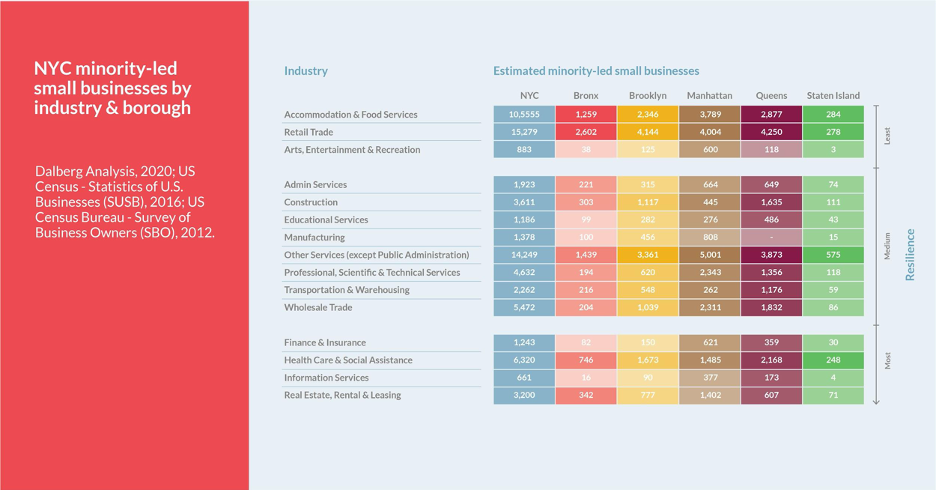

A risk to minority-owned small businesses is a risk to the entire city. Minorities account for more than half of New York City’s population and it has the highest rate of minority ownership of small businesses of any major city in the country. The city’s 220,000 small businesses employ nearly 2 million New Yorkers – almost half of the city’s workforce. In both Queens and the Bronx, minority-owned businesses account for almost half of all small businesses. They provide critical jobs, tax revenue, services, safety, and cultural vibrancy to their neighborhoods.

The loss of these businesses will not only shatter the livelihoods of their owners but also the livelihoods of the countless, disproportionately minority, New Yorkers they employ. These businesses are an integral part of the social and cultural fabric of the communities they anchor. Examining the impact of Covid-19 on minority-owned small businesses reveals important lessons for policymakers and businesses alike.

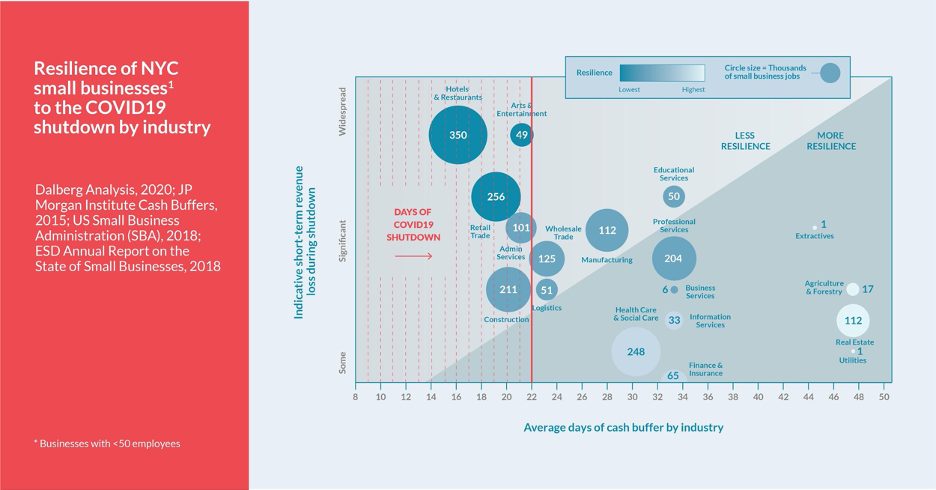

Much has been written on how historical and structural inequalities have led to New York’s minority communities disproportionately bearing the brunt of the health crisis. The economic impact of shuttering all non-essential businesses is equally devastating. High numbers of minority-owned small businesses can be found in sectors like retail, accommodation, and food service which have been hardest hit by the shutdown. These sectors saw the steepest decline in revenue, and because they also tend to maintain the lowest cash buffers, they likely endured earlier and more rapid layoffs.

It’s not only small businesses owners that are suffering. Our research found that minority-owned businesses tend to employ minorities at levels proportional to their local demographics. Furthermore, microenterprises, those employing under 20 people, are disproportionately minority owned and are amongst the most vulnerable in the unfolding economic crisis. They account for as many as 25% of all jobs in Brooklyn and Queens. Not only did they come into the crisis with relatively weak balance sheets and lower than average credit scores, but many may also lack the resources necessary to effectively access federal support programs like the PPP.

So how can these negative impacts be mitigated? First, the government needs to increase direct and immediate financial support to minority-led businesses, especially the smallest ones. The April 21st ‘interim’ economic stimulus package is a step in the right direction – ensuring that some of the Paycheck Protection Program funds flow through smaller financial institutions that have proven to be better able to reach small businesses, particularly those that are unbanked. But the next bill must go further and ensure that funds are specifically earmarked for struggling small and minority owned businesses.

Second, in addition to financial support, robust technical assistance is needed, tailored by neighborhood and industry, to help businesses navigate accessing funds. The South Bronx Business Lab has seen a 60-fold increase in the number of enquiries and support requests. As community banks and small business assistance networks become over-stretched, these are the most primed channels by which to provide non-financial support to the hardest hit small businesses and communities.

And third, small businesses will need to utilize these resources and their own creativity to adapt to the changing business climate. Emerging examples of adaptation include Bodegas that reach customers through newly launched delivery service aggregators and fashion companies that have switched gears to produce facemasks. However, given the likelihood of heightened hygiene concerns, other businesses, such as nail salons, where 80% of staff are minority workers, will face longer-term adaptation challenges as they work to attract customers back to their establishments. While small businesses can be agile, they are more vulnerable if forced to adapt quickly. They are unlikely to have the necessary resources, knowledge, technology, or economic margin for error to pivot quickly and effectively. Thus, evolving their business models cannot be the only solution. There needs to be a holistic package of changes – financial support, technical assistance to access funds, and access to technology and training to adapt their businesses.

These actions can both mitigate the immediate impact of Covid-19 and position NYC for an equitable recovery. If we want to emerge as a stronger New York without losing our identity, we should give minority-owned businesses the support they need and right away.