Dalberg uses cookies and related technologies to improve the way the site functions. A cookie is a text file that is stored on your device. We use these text files for functionality such as to analyze our traffic or to personalize content. You can easily control how we use cookies on your device by adjusting the settings below, and you may also change those settings at any time by visiting our privacy policy page.

The size and urgency of support needed for Latin American and Caribbean small and growing businesses (SGBs) amid Covid-19 recovery is considerable. The question becomes not whether funders should support small businesses but how. Dalberg Associate Partners, Kusi Hornberger and Fabiola Salman, outline four focus areas to help ensure maximum impact. The original article can be viewed here.

Small and growing businesses are significant actors in economic production, employment, and growth in Latin America and the Caribbean. According to the OECD, these SGBs comprise 99 percent of the region’s almost 28 million formal private enterprises and contribute to roughly two-thirds of all employment and one-third of production in the region. In addition, research shows a strong, positive association between small businesses and income growth.

The COVID-19 pandemic and associated economic crisis have had a significant negative impact on both SGBs and the financial intermediaries that serve them. The UN Economic Commission for Latin America and the Caribbean (ECLAC) estimates there was a GDP contraction of 7.7 percent in 2020 across the region, resulting in the closure of over 2.7 million businesses and the loss of 8.5 million jobs.

According to the IFC, before the crisis the region’s SGBs faced an annual financing gap of more than one trillion dollars, with women-led businesses experiencing one-third of that gap. The crisis has only expanded this financing gap and has further exacerbated the existing inequalities impacting small businesses. Our own survey of 95 capital providers operating in the region revealed that 80 percent of them have one or more portfolio company needing restructuring or additional financing, and another 80 percent of these portfolio companies have funding requirements greater than $50,000. Using conservative assumptions, this suggests that the region’s financing gap could easily triple in the next year.

Considering the size and urgency of the support needed, the question becomes not whether funders should support small businesses in Latin America and the Caribbean but how. The remainder of this post proposes four focus areas to help ensure maximum impact.

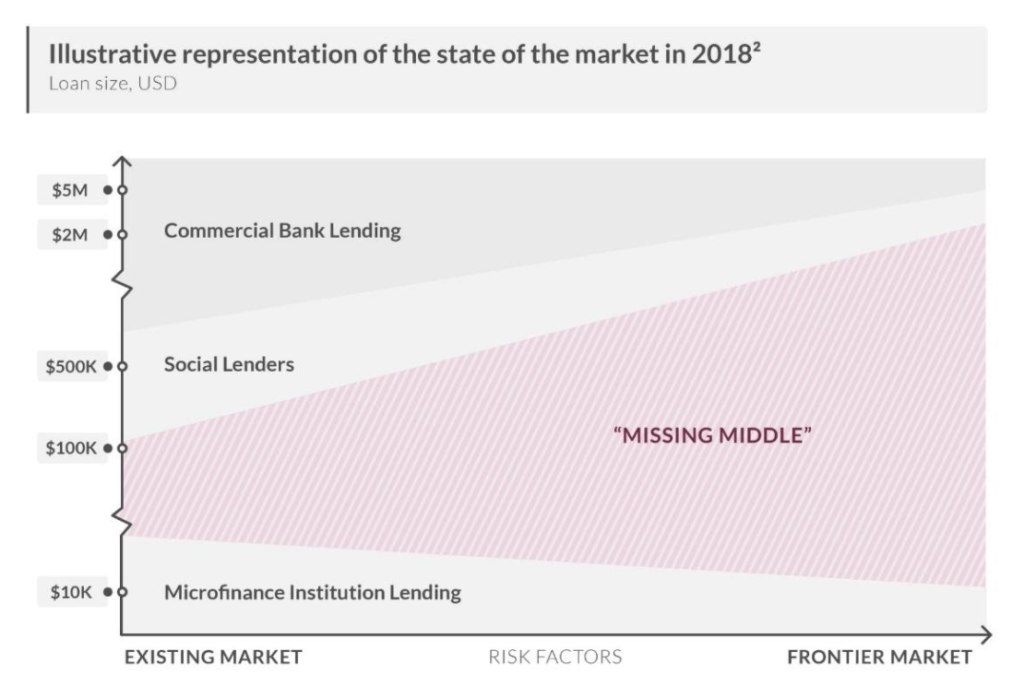

1) Catalyze capital providers that finance the real missing middle.

Most SGBs in the region have financing needs between $20,000 and $500,000. Our research has shown, however, that due to operating costs, segment risks, and costs of capital, it is very difficult to serve those needs without subsidized capital (see figure below). Thus, commercial debt providers and private equity players typically seek to place investments north of one million dollars, at a minimum. At the other end, microfinance institutions and non-banking financial institutions rarely offer individual credit north of $50,000, either for regulatory reasons or due to the opportunity costs of serving this underdeveloped market segment. This leaves most missing-middle Latin America SGBs massively underfinanced. More catalytic de-risking capital that allows fund managers like ALIVE, Gawa Capital, Grassroots Business Fund, Mercy Corps Social Ventures, Pomona Impact, and others to stay impact-first when targeting this missing middle is urgently needed.

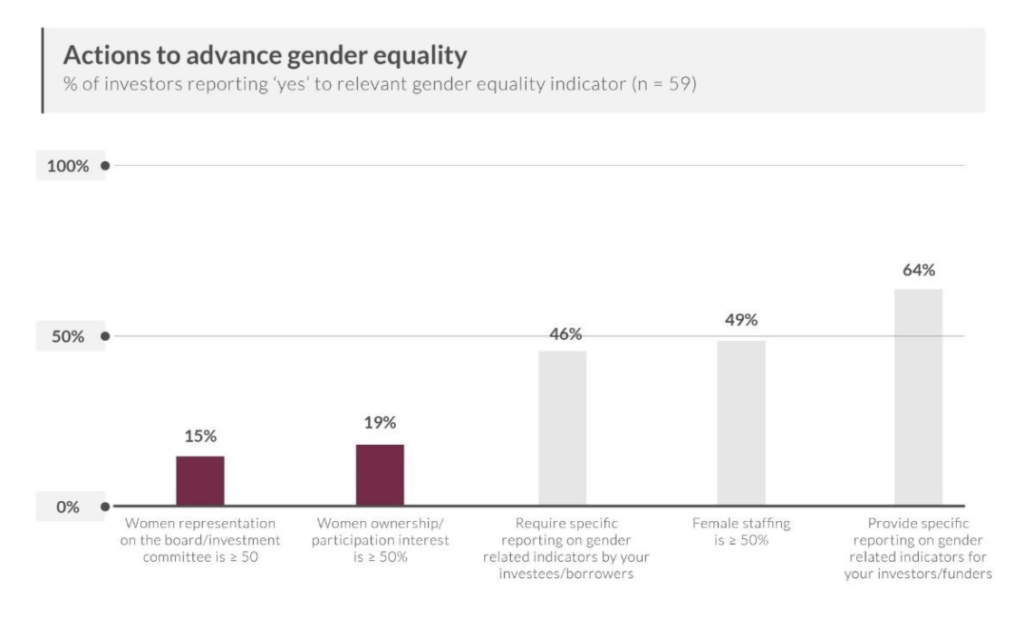

2) Finance capital providers that go beyond good intentions on gender equity.

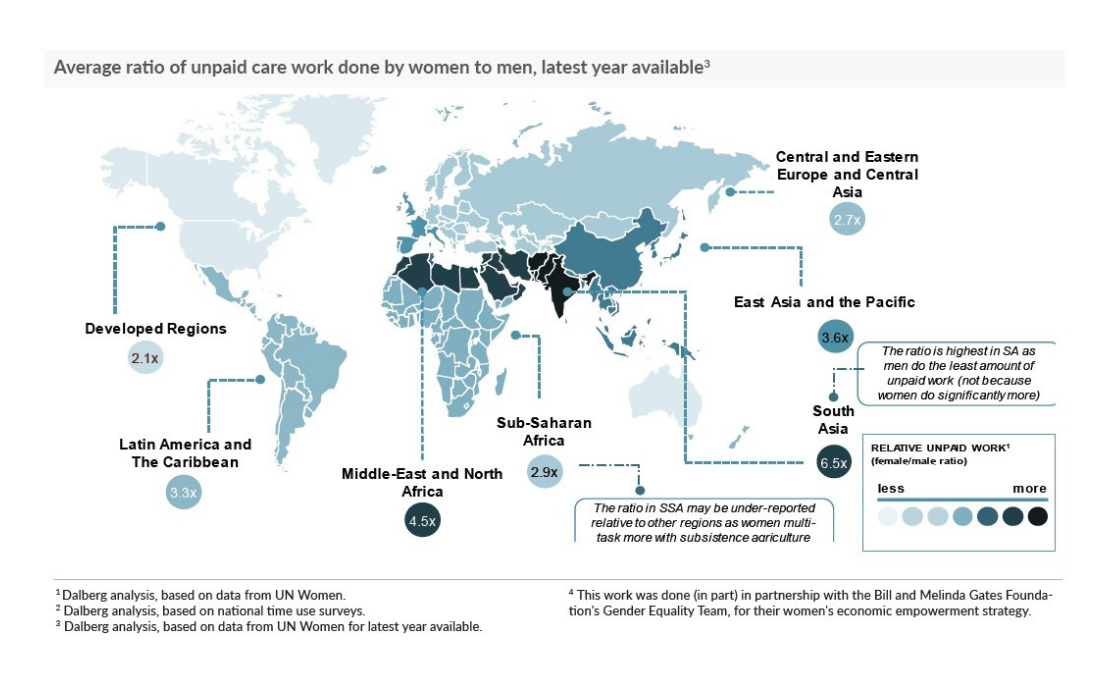

Before Covid-19, women in Latin America represented 45 percent of business owners, second only to China globally. Several countries such as Colombia, Ecuador and Panama were making advances in actively supporting women entrepreneurship. However, these businesses are being hit harder as women have a higher participation in the most impacted sectors such as commerce, domestic work, tourism, and others. As a result the pandemic will leave 118 million women and girls in poverty across Latin America, according to UN Women.

Our research reveals a gap between discourse and action when it comes to gender equality and job creation in the region. Our survey shows that even though 40 percent of capital providers indicate that they align with SDG 5 on gender quality and have begun to collect and share data on gender equity, less than 20 percent of those same capital providers have women ownership or board representation (see the figure below). Further, while the region has some great female founders, inequalities in access to VC hampers their achievements. According to LAVCA data, only about 13 percent of venture capital goes to female founders.

To fully support recovery, funders and investors must place the unique needs of women entrepreneurs at the center of their strategies. This means more broadly considering women entrepreneurs as they assess target companies, cultivating and support a network of female mentors, support businesses that create products and services that empower women and eliminate the gender pay gap in their investees.

3) Scale effective “digital” models that are providing services to harder hit dynamic and livelihood-sustaining enterprises.

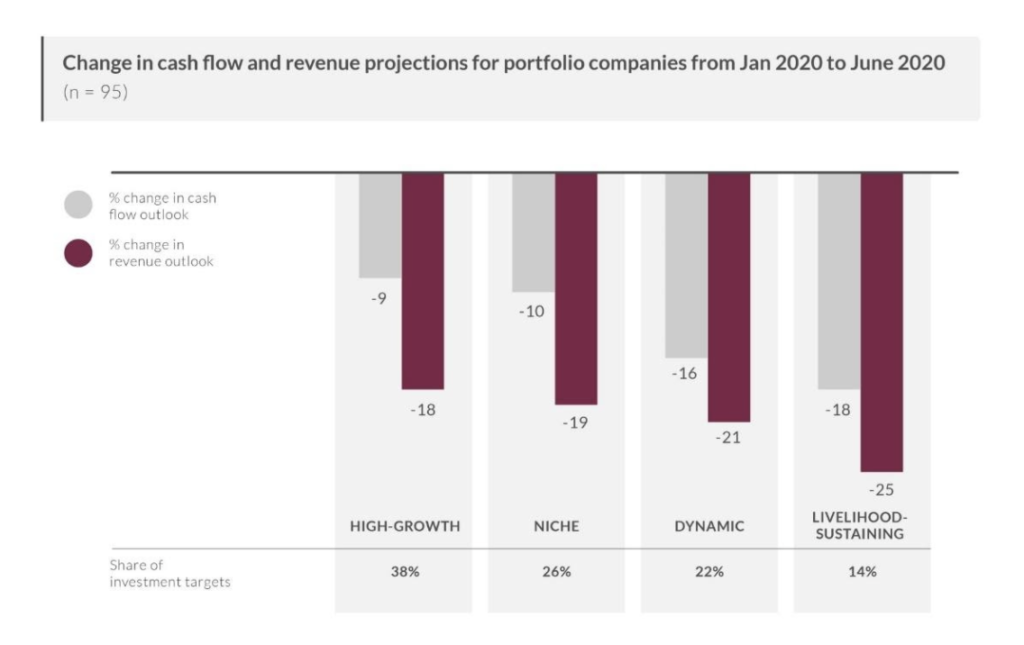

While disruptive high-growth ventures like unicorns Mercado Libre, NuBank, and Rappi attract high levels of attention in the region, the reality is that the vast majority of the region’s business activity and employment (see above) are in either traditional medium- sized dynamic enterprises or Livelihood-sustaining enterprises (this report explores this segmentation). Our own research suggests that these segments have also been disproportionately impacted in terms of cash flow and revenue performance (see the figure below).

These segments require a radically different model than that offered by most traditional commercial banks, impact investors, and PE/VC funds. Using new finance pathways that leverage data and digital approaches that leverage internal knowledge and automate decision making can help by radically lowering the cost to serve these segments. Players like Konfio and Sempli’s technology infrastructure limit in-person interaction and can reach many small businesses with urgent needs but limited access to traditional finance, helping these SGBs emerge from the COVID-19 crisis stronger than before.

Additionally, it is key to support SGBs to fully embrace digital technologies with technical support, skill building, and infrastructure support. The vast majority of businesses are not ready to fully digitalize or leverage data to standardize processes due to the substantial capital investments required to do so. The pandemic has accelerated the rate of digitalization in the region, and we should make sure SGBs are part of this transformation.

4) Don’t forget the critical role business development support plays in helping SGBs grow.

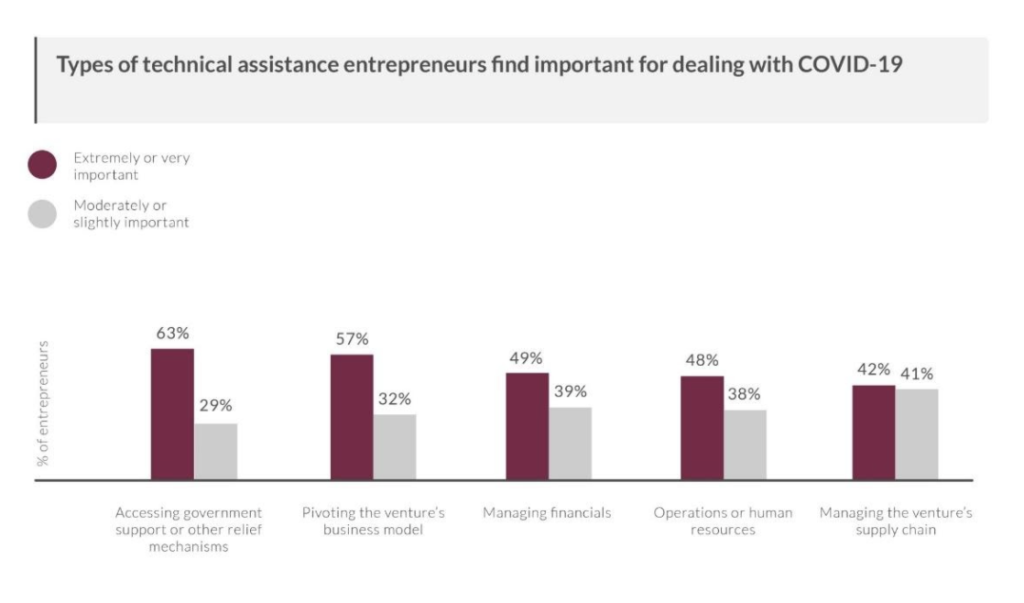

Most businesses in the region have (re)discovered the hard way how important nonfinancial support is to make it through a crisis. To position themselves on a path to renewed growth post crisis, SGBs need technical and managerial support to complement additional financing. Our research has shown that the top areas for which technical and managerial support are needed are finance and debt management, strategic planning, and support to reinvent business models (see the figure below). While a growing mountain of evidence shows how training can support entrepreneurs in increasing revenues and profits, most capital providers in the region still do not raise money for it. This represents an unrecognized need in the market. Organizations in the region like Bridge for Billions, FUNDES, and TechnoServe are leading the way with innovative digital approaches that could be scaled, but more support will be needed to do so.

Latin American SGBs are in crisis. More funders are urgently needed to increase overall commitment to the region, and both new and existing funders must respond in ways that maximize impact rather than disbursements volume alone.